In today’s dynamic business environment, making informed decisions has become crucial. An essential measure to achieve this is due diligence. It is a process that helps businesses, investors and stakeholders assess risks and make the right choices. But what does due diligence mean, and why is it important – let’s find out.

Definition and Meaning of Due Diligence.

The term due diligence originated from the legal sphere, referring to the reasonable steps to avoid committing a wrong. In business and finance, it means conducting a thorough investigation or audit of a potential investment, business partnership, or purchase.

Types of Due Diligence

There are several types of due diligence, each focusing on a different aspect of a business or transaction. Here are the main types:

1. Legal Due Diligence

- Focus: Evaluate the legal aspects of the business or asset.

- Scope: Includes reviewing contracts, intellectual property rights, compliance with laws, ongoing litigation, regulatory requirements, licenses, and permits.

- Purpose: Ensures that the business is legally compliant and identifies any potential legal risks or liabilities.

2. Financial Due Diligence

- Focus: Analyses the financial health and performance of the company.

- Scope: Involves examining financial statements, profit and loss accounts, balance sheets, cash flow statements, taxation records, and financial forecasts.

- Purpose: Assesses the accuracy of financial reporting and ensures that the company’s financials reflect its true value and performance.

3. Commercial Due Diligence

- Focus: Evaluate the market position and commercial viability of the business.

- Scope: Involves analysing the company’s market size, growth prospects, competitors, business model, sales channels, customer base, and marketing strategies.

- Purpose: Assess the business’s growth and profitability potential and evaluate the commercial risks involved.

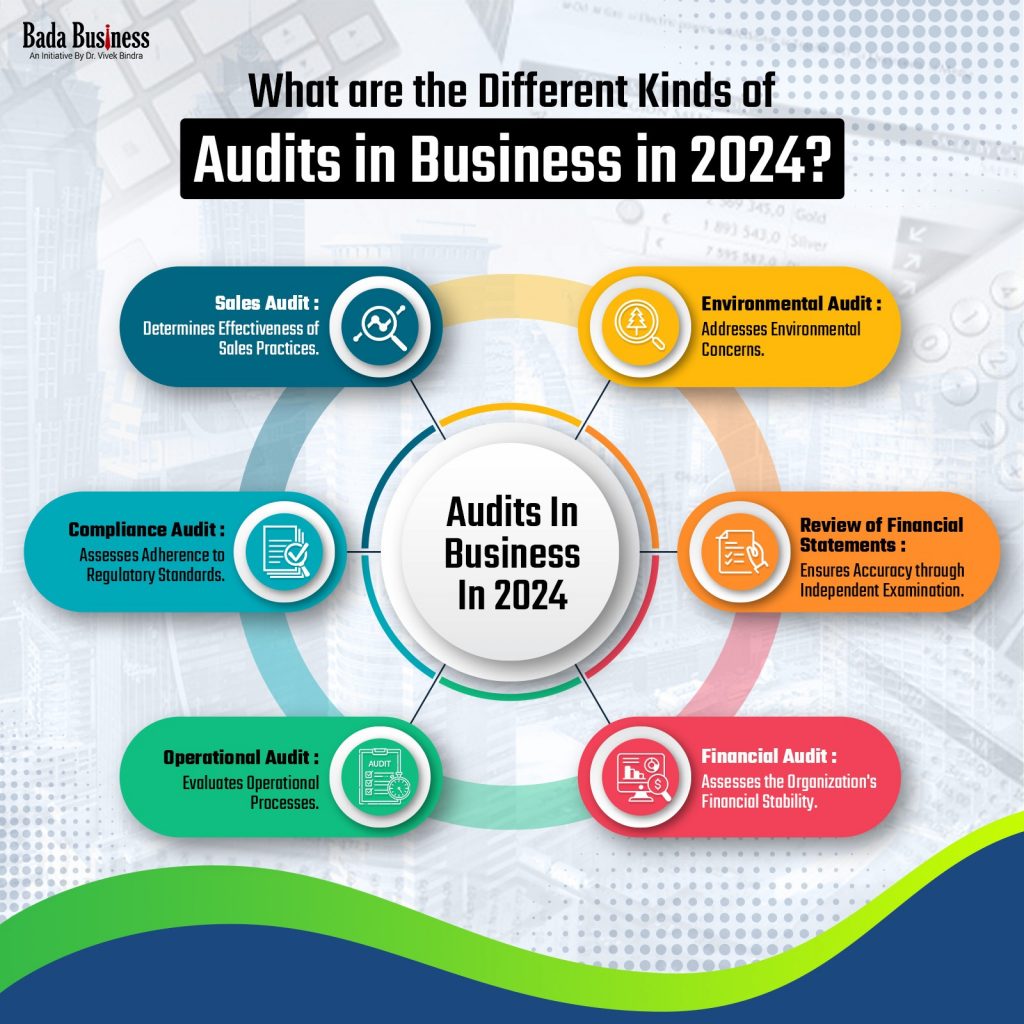

4. Operational Due Diligence

- Focus: Assesses the company’s operations and processes.

- Scope: Includes evaluating the efficiency of operations, technology, supply chain management, production processes, organisational structure, and quality control systems.

- Purpose: Identifies operational risks, potential inefficiencies, and areas for improvement.

5. Tax Due Diligence

- Focus: Examines the company’s tax compliance and liabilities.

- Scope: Involves reviewing past tax filings, outstanding tax obligations, tax credits, and any tax disputes or audits.

- Purpose: Ensures that the business complies with tax regulations and identifies potential tax-related risks.

6. IT (Information Technology) Due Diligence

- Focus: Assesses the IT infrastructure and technology systems of the company.

- Scope: Includes evaluating the company’s software, hardware, cybersecurity measures, data management practices, and IT support systems.

- Purpose: Ensures that technology systems are secure, efficient, and scalable to meet the business’s future needs.

7. Human Resources (HR) Due Diligence

- Focus: Evaluate the company’s human resources policies and employee relations.

- Scope: Involves reviewing employment contracts, employee benefits, compensation structures, compliance with labor laws, and any ongoing HR issues or disputes.

- Purpose: Assesses workforce quality, compliance with employment regulations, and potential HR-related risks.

8. Environmental Due Diligence

- Focus: Examines the environmental impact of the business’s operations.

- Scope: Includes evaluating compliance with environmental regulations, environmental liabilities, waste management practices, and sustainability initiatives.

- Purpose: Identifies environmental risks and ensures compliance with regulatory standards to avoid penalties or legal issues.

9. Strategic Due Diligence

- Focus: Analyses whether the target company aligns with the acquiring company’s strategic goals.

- Scope: Involves evaluating the target’s business model, synergy potential, market position, and overall strategic fit.

- Purpose: Ensures that the acquisition or partnership aligns with the long-term strategy and objectives of the acquiring business.

10. Cultural Due Diligence

- Focus: Assesses the cultural fit between merging or partnering organisations.

- Scope: Evaluate the work culture, management style, company values, and employee engagement levels.

- Purpose: Helps predict potential integration challenges and ensure a smooth transition during mergers or acquisitions.

Each type of due diligence plays a critical role in evaluating different aspects of a business, ensuring that potential risks are minimised, and the true value is accurately assessed.

Importance of Due Diligence.

Due diligence is an essential aspect of business transactions. It helps organisations and investors:

- Minimise Risks: By understanding potential risks, companies can avoid pitfalls and make better decisions.

- Evaluate Business Value: Assessing all aspects of a business, from finances to operations, helps determine its actual value.

- Ensure Compliance: It ensures that all legal and regulatory requirements are met, avoiding future legal challenges.

- Build Trust: Thorough due diligence promotes transparency and builds trust among investors, partners, and stakeholders.

Due Diligence Process.

The process typically involves several stages:

- Initial Assessment: Collecting and reviewing preliminary information about the business or asset.

- In-depth analysis: Examining documents such as financial statements, contracts, and operational reports.

- Reporting and Decision-Making: Summarising findings in a report and using the information to make an informed decision.

Examples of Due Diligence.

Due diligence is often used in scenarios such as:

- Mergers and Acquisitions: Evaluating a company’s financial health and operations before a merger or acquisition.

- Real Estate Transactions: Assessing property value, legal ownership, and any potential issues before buying.

- Venture Capital Investments: Reviewing startup business plans, market strategies, and financial forecasts before investing.

Challenges in Conducting Due Diligence.

Despite its importance, due diligence is not without challenges:

- Limited Information: Sometimes, access to necessary information may be restricted.

- Time Constraints: Tight deadlines can limit the depth of the investigation.

- Complexity: Cross-border deals can involve additional legal, regulatory, and cultural complexities.

Best Practices for Effective Due Diligence.

To ensure thorough and effective due diligence, businesses should:

- Engage Experts: Work with experienced professionals such as lawyers, accountants, and consultants.

- Plan Strategically: Develop a clear and structured due diligence plan tailored to the specific situation.

- Monitor Continuously: Keep updating findings and monitoring the situation to make informed, timely decisions.

Conclusion

Due diligence is a critical process that helps mitigate risks, maximise value, and build trust. For businesses and investors, incorporating due diligence into their decision-making is not just a best practice—it’s an essential step for sustainable success.